inheritance tax malaysia

By compounding this 35 rate annually for 43 years the minimum value of the property from RM20000 in 1977 would have increased to RM87794 in 2020. Asked on Apr 2 2001 at 1850 by.

Budget 2020 It S Time For Wealth And Inheritance Tax

By compounding this 35 rate annually for 43 years the minimum value of the property from RM20000 in 1977 would have increased to RM87794 in 2020.

. As a non-resident youre are also not eligible for any tax deductions. Its previous version was revoked back in 1991. Luxury and excise duties Excise duties are imposed on a selected range of goods manufactured and imported into Malaysia.

151 rows The headline inheritance and gift rates are generally the highest statutory rates. 4882 Views Asked 21 Years Ago. Impose wealthinheritance taxes New Straits Times.

Malaysia used to have the Estate Duty Enactment 1941 which served like the inheritance tax. My mom owns a house in Malaysia. Malaysia - More data and information How high is income tax on residents in Malaysia.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. This table provides an overview only. Property prices in Malaysia.

There is currently no tax for property inheritance in Malaysia. 2 This Act shall apply throughout Malaysia but shall not apply to the estates of deceased Muslims or natives of any of the States in Sabah and Sarawak. Malaysian Government has doubled the minimum value of properties that foreign interests could buy to RM1 million from RM500000 currently as listed down in the Table below for the Penang Johor and Federal Territory of Kuala Lumpur Labuan and Putrajaya.

List View Map View NA stands for Not Applicable ie. Inheritance Laws in Malaysia. There are no inheritance estate or gift taxes in Malaysia.

Receiving tax exempt dividends. Taxes arent usually involved but inheritance tax applies to inheritances worth more than 25000. See the territory summaries for more detailed information.

Graph of house price trends in Malaysia Where to by property in Malaysia. However in recent years there have been talks of reintroducing inheritance tax by successive governments. At the time assets of a deceased individual valued beyond RM2 mil was subject to an estate tax between 05 and 10.

An estate of a deceased was liable to a five per cent tax if it was valued above RM2 million and 10 per cent if it was above RM4 million. However it was abolished 1991. There is currently no inheritance tax in Malaysia.

In the case of a inherited property stamp duty might become a consideration. However this legislation was repealed in 1991. The quick answer is no.

CAP has asserted before that the average Malaysian shouldnt fear the inheritance tax. We do not have the inflation rate of Malaysia from 1977 until 2020 but for arguments sake we will use a prudent rate of 35. Govt Public Policy.

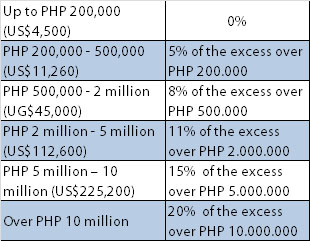

As of Budget 2020 no new laws on inheritance tax have been introduced. The prime reason was due to poor tax collection as the tax was only applicable to a specific threshold and was only applicable when a person died. In the present context the inheritance tax rate for Malaysia should now be at least 50 percent for estates valued at between RM2 million to RM3 million with a progressive increase as the inheritance amount gets higher.

But is this official inflation rate of 35 an accurate representation of what is actually experienced by the people. 1 This Act may be cited as the Inheritance Family Provision Act 1971. Inheritance Inheritance tax and inheritance law in Malaysia Taxation Researcher April 04 2022 INHERITANCE No inheritance or gift taxes are levied in Malaysia.

This is because they do not have to. Inheritance tax in Malaysia was abolished back in 1991. During that time net worth assets exceeding RM2 mil were taxed at 5 and 10 on net worth assets exceeding RM4 mil.

The territory does not have the indicated tax or. The house insurance bill tax sent a fine under dads name and mum said she had to pay extra RM30 because bill was not settled on the date my dad passed away. Property tax Property tax is levied on the gross annual value of property as determined by the local state authorities.

If taxable you are required to fill in M Form. An inheritance tax was implemented in Malaysia under the Estate Duty Enactment 1941. A foreigner not just Singaporean citizens may only own or inherit property in Malaysia if the state government has granted authorization.

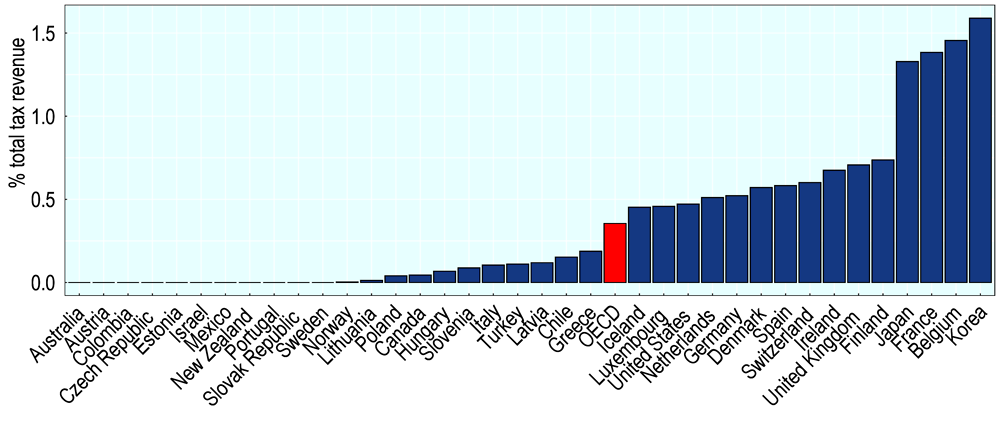

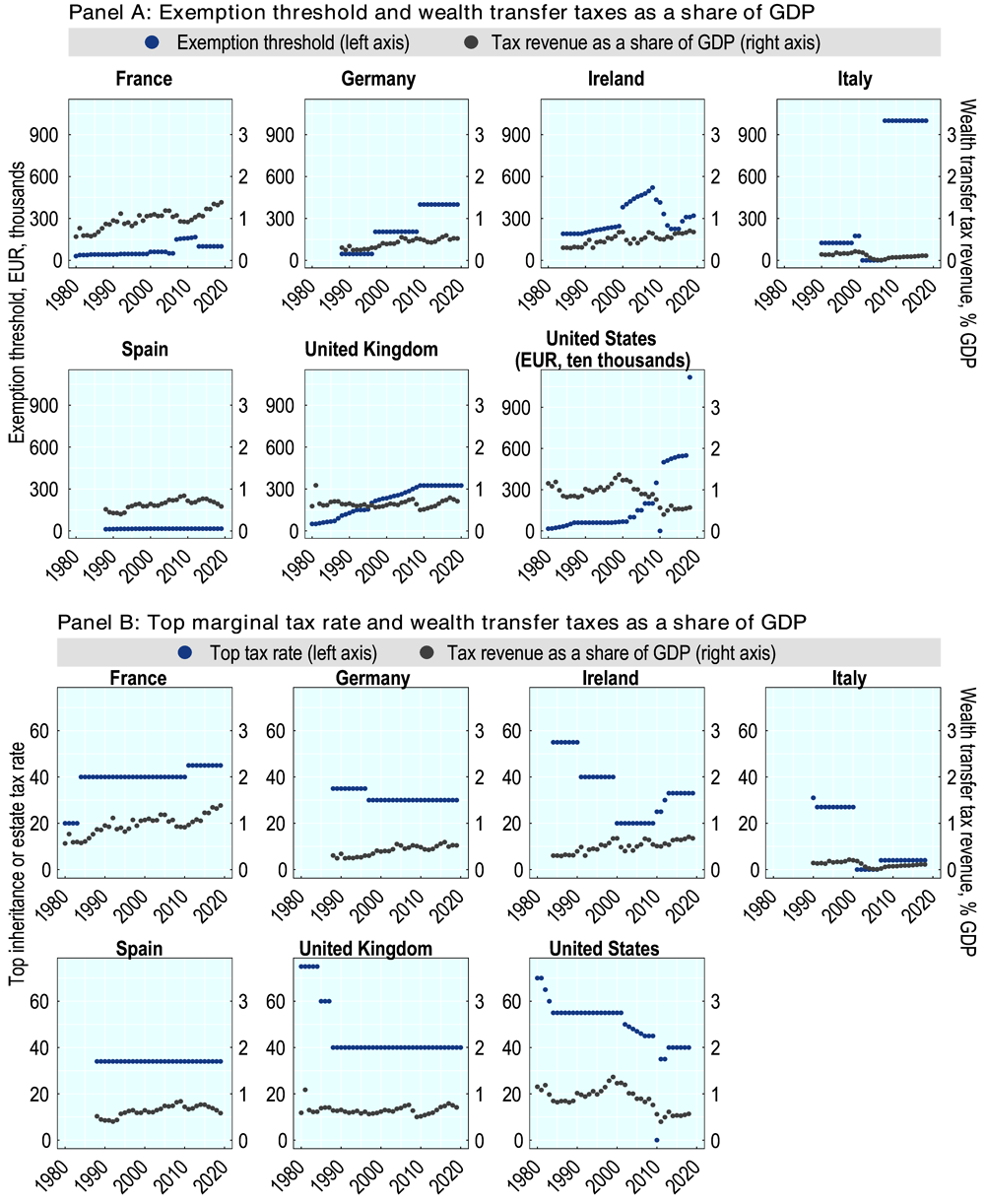

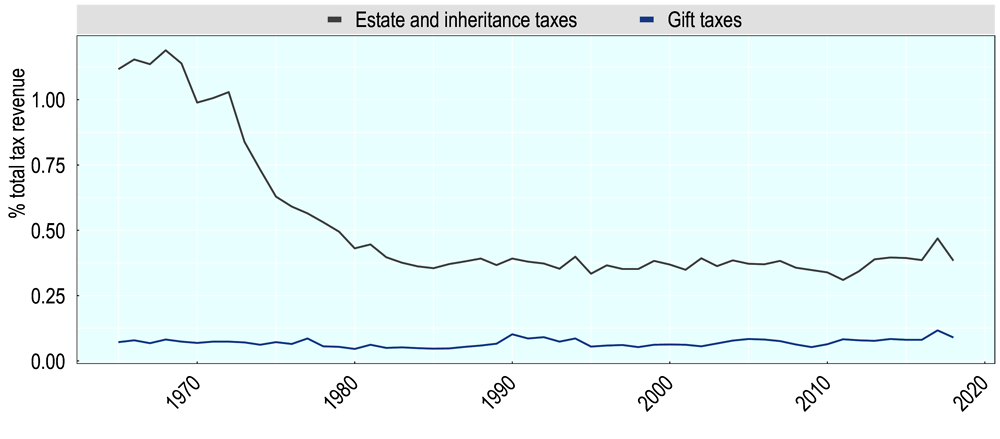

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

On Last Few Weeks 20hb July Sell Back Physical Gold Bar With Affin Bank The Bank Buy Back Policy And Procedure Quite Simple Com Physics Gold Bar Finance Tips

Inheritance Taxation In Oecd Countries En Oecd

Bkash Mobile Money Job Opening Good Communication Skills Job

These 22 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Business Insider Business Insi Money Concepts Finance Estate Planning

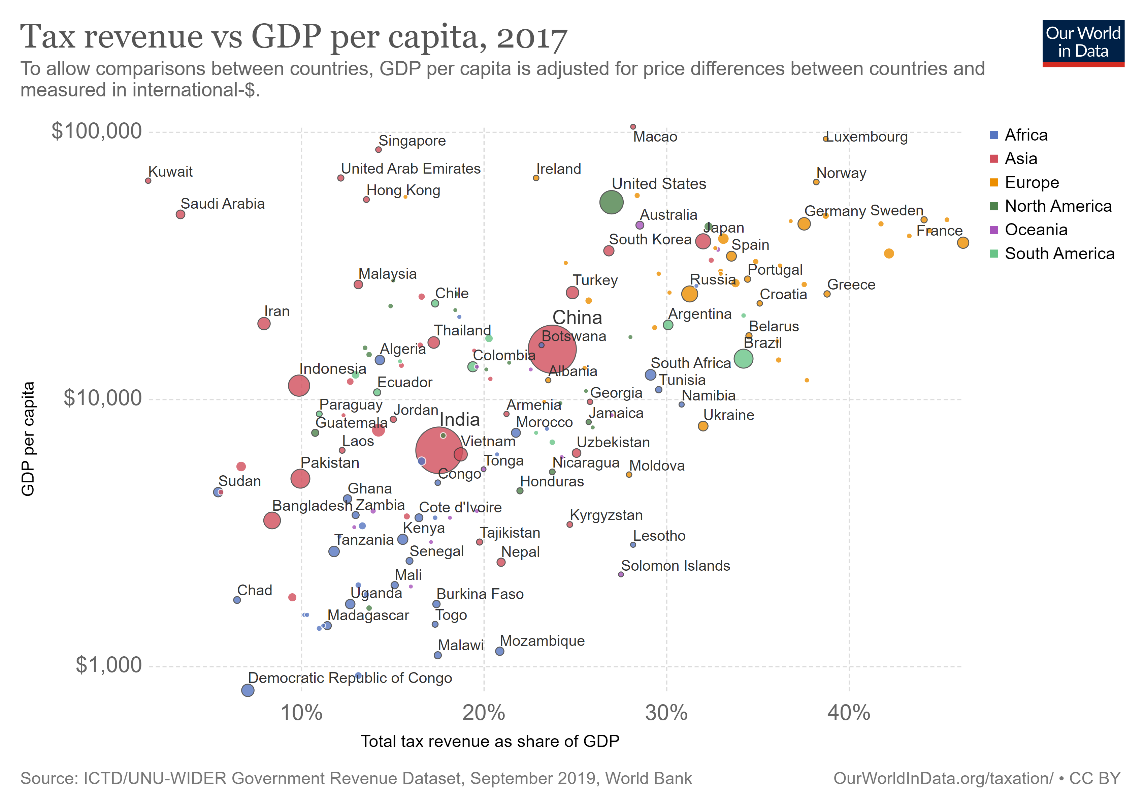

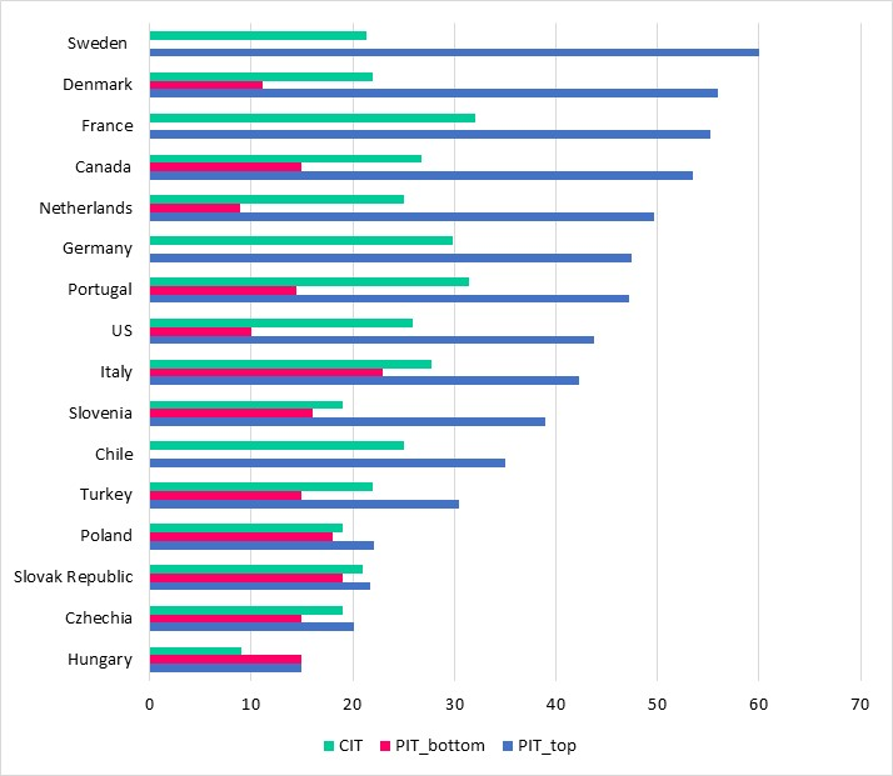

Taxes Around The World Why We Need Taxes And What Makes A Good Tax Policy Voxukraine

1 Nov 2018 Budgeting Inheritance Tax Finance

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

Taxes On Real Estate In France On The Purchase Maintenance Accommodation Sale For Citizens And Residents Hermitage Riviera

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

白金地产广告展板背景板 City Photo Photo Aerial

Tax Experts No Need For Capital Gains Inheritance Taxes

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template

Is Inheritance Tax Payable When You Die In Singapore Singaporelegaladvice Com

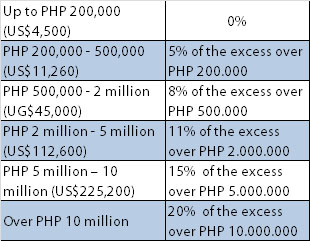

Understanding Inheritance And Estate Tax In Asean Asean Business News

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

1 Nov 2018 Budgeting Inheritance Tax Finance

Taxes Around The World Why We Need Taxes And What Makes A Good Tax Policy Voxukraine

Comments

Post a Comment